Protecting yourself financially during divorce

I HAVE BEEN PRACTICING AS a financial advisor in divorce for more than 25 years, and in the last 10 years the divorce rate in the U.S. for adults over the age of 50 has doubled. This sharp increase in breakup rates is in first-time, long-term marriages of more than 20 years. My parents’ generation had an estimated divorce rate of 2.8%, but today 24% of baby boomers file for divorce, the highest of any age bracket.

Generally speaking, the older you are, the more complicated divorce is financially. At this stage, older adults face a lot of challenges, including holding demanding jobs, running businesses, paying for college tuitions, caring for elderly parents, managing increasing health care costs, supporting adult children and balancing lifestyle expenses with saving for retirement. The transition to and uncertainty of a divorce outcome on the cusp of retirement implies fewer years to generate savings or replenish assets. It also means fewer earning years and, eventually, reduced income, both of which are factors that may limit spousal support in amount and term.

What makes divorce problematic for people in their late 50s is that each spouse may have very different expectations about their retirement. It is not unusual for one spouse to lack knowledge about retirement savings and resources, which typically makes them less prepared for divorce. This can create real fear and angst.

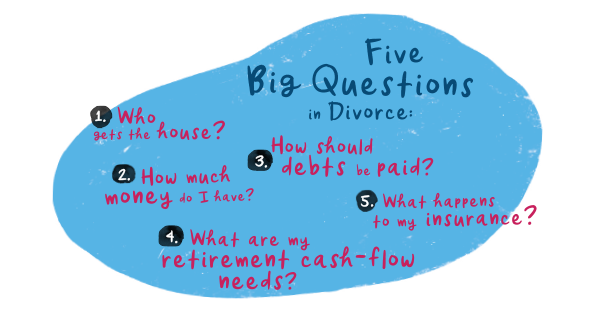

Anyone contemplating or going through a divorce should prepare themselves by taking five key steps in order to address the five big questions:

1. Research. What kind of legal process is best for your situation: mediation, collaboration or litigation?

2. Gather and organize. Bring together in one place all of your financial information that will be necessary to evaluate your financial lifestyle and needs. The more you can do yourself, the less expensive the discovery phase will be.

3. Make sure you have access to financial resources to cover bills and professional retainers up front. For example, identify which accounts will be used or, alternatively, agree to borrow as needed.

4. Check your own credit history and rating. Obtain a free annual credit report from all three agencies, and address any errors or problems.

5. Make a list of your priorities, concerns and challenges for the divorce outcome. For example, pay for college, retrain to re-enter the workforce, obtain health insurance, relocate, keep the house, etc.

Finally, older divorcing couples may have adult children or elderly parents they want or need to support. A divorce agreement will sort out arrangements regarding minor children, but there is no legal obligation to pay child support past majority age. This is a big issue for baby boomers: How much will they continue to support young adult children? If you’ve been paying rent for your daughter in college, and you want to continue to do so but your spouse does not, you may need to come up with that money on your own. The same applies for home health care for an aging parent, for instance.

Divorce often lights a match to these stressors, exacerbating all financial issues by now dividing finite wealth into two households. Divorce is an everyday reality — and more marriages fail than succeed. Everyone is affected by the process. You can help yourself and your loved ones by learning about the divorce process and the tools necessary to navigate and achieve a long-lasting and holistic resolution.

Lili Vasileff ’77 is a certified financial planner and divorce financial analyst with experience in divorce financial planning and wealth management. She is a trained mediator, collaborative financial specialist and qualified litigation expert and the author of three books, including “Money & Divorce: The Essential Roadmap to Mastering Financial Decisions.” Learn more at wealthprotectionmanagement.com.

Lili Vasileff ’77 is a certified financial planner and divorce financial analyst with experience in divorce financial planning and wealth management. She is a trained mediator, collaborative financial specialist and qualified litigation expert and the author of three books, including “Money & Divorce: The Essential Roadmap to Mastering Financial Decisions.” Learn more at wealthprotectionmanagement.com.

May 14, 2019

Leave a Reply